High rise, Preconstruction

Part 2 in a 2-part series: When the stakes are high, how can you trust your contractor to protect your investment?

Last week, Project Director Shawn Dziedzic discussed 7 considerations when planning your residential high rise construction project to achieve predictable outcomes. This week, we dive deeper into the seventh consideration and provide tips for making smart cost decisions - turning your theoretical budget into your actual budget.

One of the major challenges contractors have is balancing the design with the budget. With residential construction, developers want their buildings to stand out and appeal to renters. However, with a business model based on cost per square foot, they also need cost efficiency.

When we’re hired for a residential high rise project, one of the first exercises that we do is a cost analysis of the current design. The analysis looks at leading budget indicators and rates the cost efficiency of the building and its systems.

The analysis is pretty simple, and it is established through a combination of historical cost information and current market costs. By benchmarking against industry averages, we’re able to help our clients find opportunities to maximize their investment early on and show the overall cost per square foot impact as decisions are made.

As you consider the design for your next project, analyzing the following eight indicators upfront will get you closer to your budget.

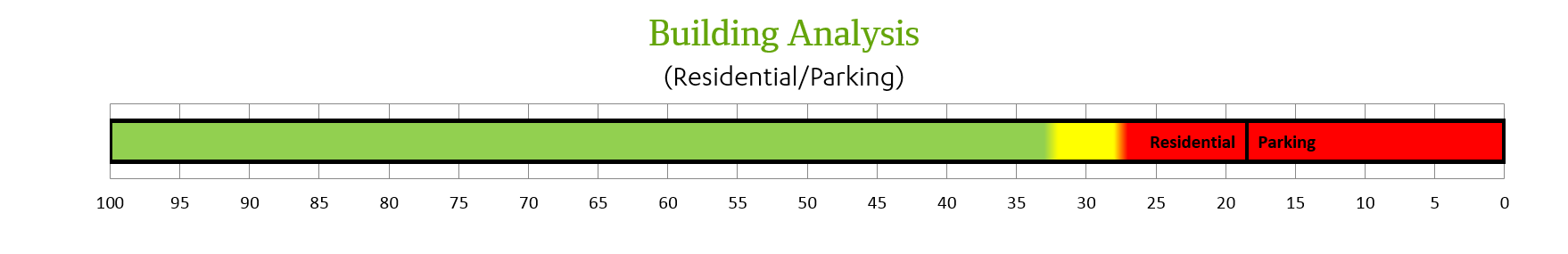

01. Building analysis

The first analysis we complete is the building’s parking to residential ratio. Generally, the most cost effective building has a mix of 30 percent parking and 70 percent residential space over the gross square foot of the building.

Since parking is less expensive to build, it helps bring down the cost of the building. However, more parking will also limit the ability to use that square footage for revenue generating space.

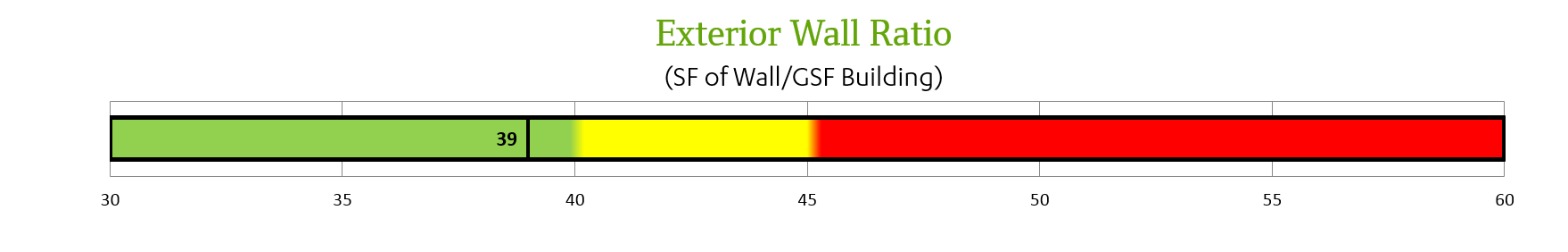

02. Exterior wall ratio

The most efficient building shape is a square, but square buildings don’t always make the most interesting structures. So besides a square building, targeting a ratio of 40 to 45 percent of exterior wall to gross square footage of the building will give the greatest efficiency.

For example, on a recent project we were engaged with the developer during the very early phases of design. The original design was a 13-story “L” shape. The project was well over budget; therefore, we analyzed the building systems individually to help identify potential cost savings. The exterior wall ratio immediately raised a red flag because it was approximately 54 percent, well above the targeted 40-45 percent ratio.

In this case, the client had the ability to gain cost efficiency by simply changing the shape of the building. They opted to adjust the design to fit a rectangular shape, add seven stories to the top of the building and re-configure the apartment units. This change reduced the exterior wall ratio to approximately 46 percent, and it made the building more efficient in terms of area, providing them additional space overall. In fact, they were able to add one more unit on each residential floor, offering additional revenue potential and ultimately helping to close the budget gap.

The other factor that can adjust the cost of the exterior wall is the type of materials that are used. This analysis is more complex so we start by looking at the square foot ratio before looking at the façade in greater detail. I have provided a brief explanation of the façade analysis at the end.

03. Parking efficiency

The building analysis, above, looks at your ratio of residential area to parking area, while the parking efficiency analyzes the actual layout of your parking spaces. This is done by calculating the gross square foot of parking area that is being allocated to each parking space. The most efficient parking layouts average 350-400 square feet per parking space. This gives us an indication of any efficiency that can be gained through the configuration of your parking.

Sometimes, we are able to re-size the spaces or lay out the spaces in a different way to make the most of the area. Other times, this efficiency is set based on design constraints, like lot size and shape or column locations, requiring us to find efficiencies elsewhere.

04. Elevator efficiency

Vertical transportation is located in the core, central to the building. When we analyze vertical transportation, we look specifically at the elevators.

Elevator efficiency can be a little more complex to analyze. We factor in the height of the building, number of stops, number of elevators shown on the design documents and the total number of residential units. From this calculation, we are able to determine the most efficient number of elevators that may be needed. The goal is to provide enough elevators to service 8-12 units per residential stop.

We use this early indicator when working with the elevator consultant to design the elevator bank. Sometimes we recommend removing elevators. Another option to save cost is a high rise bank and low rise bank.

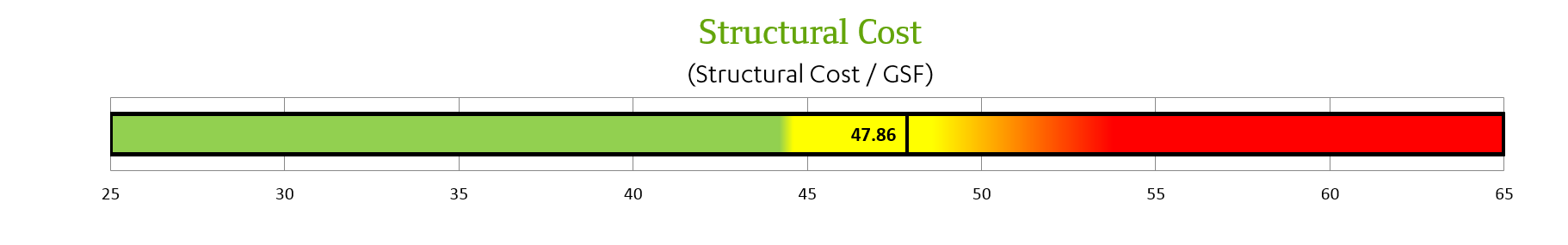

05. Structural cost

For structural costs, we target $45-50 per gross square foot of the building. Once our initial analysis is done, our construction management team can look for ways to bring the cost down, primarily by looking at the core.

While it has become commonplace to use 7.5” thick cast-in-place concrete slabs instead of 8”, due to different mixes and means and methods of installation, the placement can make a difference. Limiting the number of shear walls and designing to reduce structural load transfers will provide the greatest efficiency.

For example, re-positioning the shear-walls and columns by a foot may make the living space a little smaller, but it could save a significant amount of money. The architect and engineer don’t always know the cost implications of some of these small changes, and the construction manager can help close the communication gap between the architectural and engineering designs.

Finally, current market conditions have the most impact on the cost of the building structure. In the past 9-12 months, in particular, we have seen an uptick in the cost of cast-in-place concrete due to the current level of market activity.

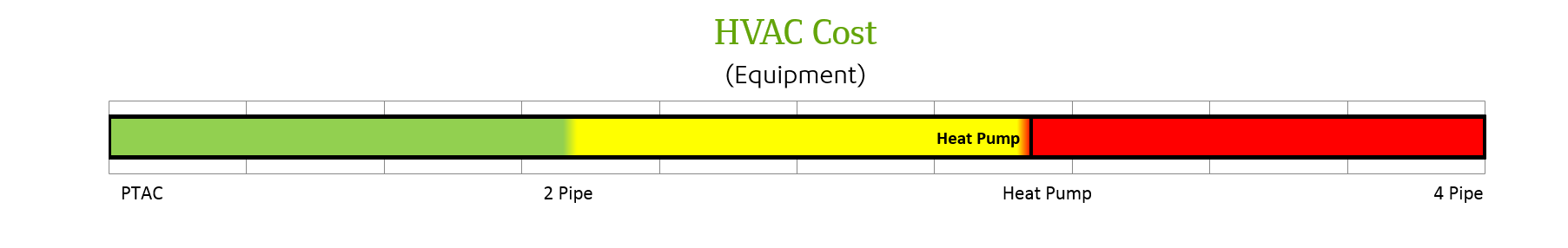

06. HVAC cost

The most commonly used HVAC systems in the residential high rise market right now are vertical or horizontal heat pumps. Although the four-pipe fan coil units allow the most flexibility for tenants to control their own temperatures based on their individual needs, they are also the most expensive.

One recommendation that Pepper has made is a hybrid heat pump, which uses both natural gas and electricity for a more cost-effective solution in terms of electricity consumption and total building energy.

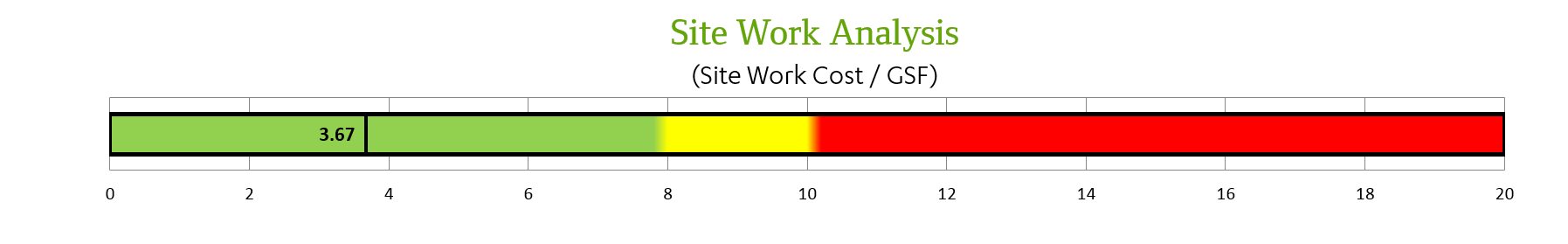

07. Site work cost

The site work will vary based on the parcel and the design, and it includes foundations, paving and landscaping. We have found the most efficient cost to be between $8-10 per gross square foot of the building. Contaminated soils and basements will make the cost higher. The less work that needs to be done, the lower the cost.

For example, on a recent project that we budgeted, the site required very little demolition, the building had no basement and the building footprint captured the entire site, therefore requiring very little paving or landscaping. The cost of the site work represented less than $4 per gross square foot of the building, which is well under the industry average.

This example is not typical. The client was able to design without a basement because they had the flexibility to build up and move the mechanicals and back-of-house systems to the first floor or the penthouse.

The flexibility to lower site costs will depend on FAR requirements (which regulate the height of the building), soil conditions and existing site conditions.

Our construction management team also works with the engineer to verify the foundations are appropriately sized and designed for the building.

08. Finishes

That leaves us with the features that sell the space: the cabinets, countertops, flooring and walls – the finishes. The finishes are more market driven than historical cost-driven, and they change more frequently. They also provide the most flexibility to choose alternate materials to save money.

We analyze the cost of finishes based on the gross square feet of residential space. Unless the developer is targeting a more affluent tenant, the goal is still to keep the cost of finishes within a lower range, even if the costs of the other systems leave them with more to spend.

While our estimating team looks at total cost per square foot, our construction management team prices the finishes using detailed assumptions that assist with decisions and allow adjustments to be made as the design progresses. Essentially, they provide a giant shopping list that breaks down the building by area and by scheme.

Bonus – Façade analysis

As mentioned above, the exterior façade can vary by the shape of the building and by the type of system that is selected. It requires a deeper analysis, which we do separately from our leading budget indicators.

The exterior envelope is one of the biggest systems so we analyze it right away. Generally, the developer knows what they want so we use that as our starting point.

The trend right now is to incorporate as much daylight as possible, so most buildings incorporate window wall or curtainwall depending on the design and budget. Often, a combination of materials is used, such as EIFS and window wall.

Once we identify what the owner wants and have a targeted cost per square foot, we hone in on one system and tweak the components – shapes, sizes, colors, mullion spacing – until we align the design with the budget and achieve the targeted exterior wall ratio.

Every high rise project uses the same building components: concrete over steel structures, efficient HVAC systems and as much glass as you can afford. Because of this, clients have found value in using our leading indicator cost analysis, and particularly when used early in the process, to help shape the design rather than adjusting the design to fit the budget.

Do you have questions about the estimating process? Submit them here.