Workplace, Future In Focus

Future in Focus

With offices re-opening as the pandemic still looms, the open office plan seems like a distant past. In what feels like a parallel universe from another galaxy, a vast portfolio of alluring communal tenant amenities are now taped like exhibits in high-rise office museums for children to view on their virtual social studies portals.

The workplace as a time capsule

It was only just a moment ago that the future of the workplace focused on the open office space plan. Removing corner offices and cubicles would enhance teamwork, improve productivity and attract the elusive Millennial to a competitive workplace. Perhaps more compelling, the open office provided building owners and their tenants a more cost-efficient and adaptable footprint from which they might grow and flex their teams.

Shared amenities surfaced, designed to attract and retain the market’s best and brightest team players: inviting coffee bars, kitchens and communal spaces for lounging, recreating, recharging, brainstorming, dining and even workplace cocktailing. In some cases, the workplace environment itself was eclipsing the organizational brand and purpose as the shiny new marketing tool.

That was then, this is now.

Right now, there is no clear vision for the future of the workplace, but we know there is a future and this pandemic-era pause will reveal a newly invigorated demand for healthier materials, smarter spaces and high-performing, sustainable buildings. As we help our clients think about the future of their workplace, we draw on our own experience.

At Pepper, we are returning to our offices with a careful, phased-in approach. We have been extremely productive while pivoting from physical collaboration to a digital hub, and we have continued to weave mobility and telecommuting into our structure.

Our offices have re-opened one at a time per state guidelines, first Ohio, then Indiana, then Illinois and finally Wisconsin, which allowed us to apply what we learned from one opening to the next. We diligently follow the CDC guidelines and have reduced our building occupancy where necessary. Staircases and hallways have been converted to one-way traffic. Signage and sanitation stations replace water fountains, and we have opened outdoor "break rooms.” Our HVAC systems have been sanitized and upgraded with MERV-13 filters to improve indoor air quality and help mitigate the spread of viruses. We now adhere to sign-in protocols and intense cleaning standards.

After nearly six months of working physically separated and in limited numbers, we see a need to be together. The true reality is that our teams thrive on collaboration and community. We need the in-person connection; it's ingrained in our culture. With a dynamic, young workforce, we are also committed to supporting rising talent with ongoing professional development, and we believe that is best served by being together, when it is safe.

And we don’t think we are alone in this long-term view.

Proceeding with new office space

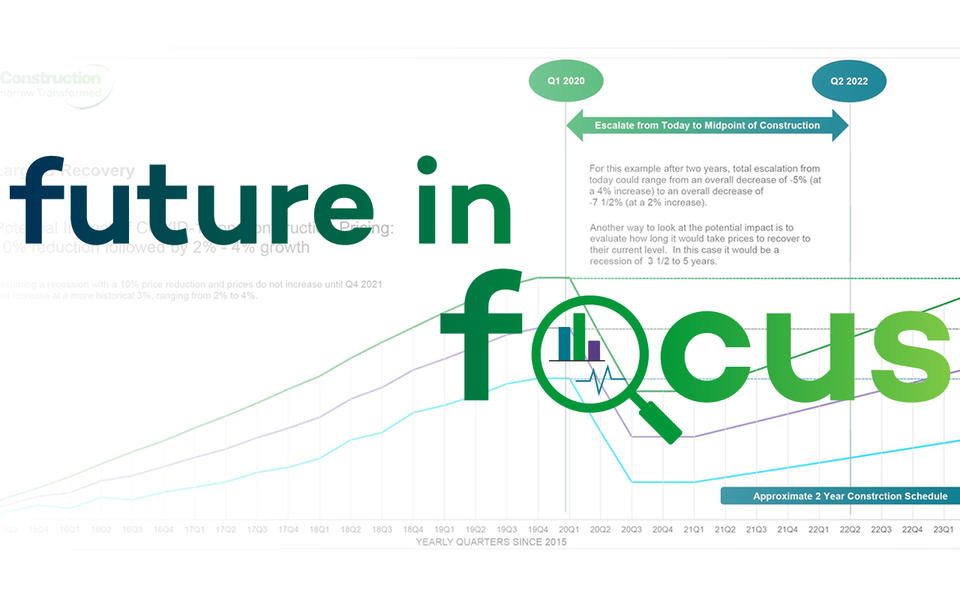

Looking ahead, we think office workers, employers and landlords will drive different demand, and pricing will follow. Commercial real estate values are vulnerable as speculation grows. Already, we're seeing inquiries for flexible spaces with upgrades under shorter lease terms.

“We're hearing analyst estimates that millions of square feet are swelling the sublease markets, which will create a surplus of space and most likely cause rental rates to dip,” suggests Tony Smaniotto, Director of Business Development, Workplace Division for Illinois. "Given that a large majority of available subleases are raw or lightly used Class A space, it could be awhile before we see new office buildings under construction."

The future of the workplace in the Midwest

Data across national pulse points -- the Federal Reserve, CoreNet Global and real estate firms like CBRE -- suggest dire market conditions in the short term and result in a work environment that is forever altered. COVID-19’s full impact on the U.S. office market was evident in the second quarter, with the largest quarterly drop in demand since 2011. Pepper’s current model suggests cautious optimism, with gradual, steady declines in rental rates and leasing activity for several more quarters, followed by market stabilization in mid-2021. Our pipeline still shows a majority of the work is paused rather than stopped. What supports these statistics?

- Deemed a real game changer, Work from Home (WFH), or some form of it, was considered a permanent option at first. Those in the technology sector specifically were ready to abandon a shared office space altogether, but that conclusion is waning as they realize areas of diminished productivity and relationship-building from prolonged separation among teams. Though, they have already contributed a lot of sublease space to the market.

- Employers who wish to maintain a physical footprint and connectivity with their teams are searching for ways to de-densify their space by acquiring more square footage, staggering onsite staffing schedules or incorporating mobile strategies.

- Alternative spaces, such as subscriptions to co-working spaces or creating a “hub-and-spoke” footprint that allows for hoteling-offices closer to workers' homes are being considered to mitigate the risks associated with density and commuting.

- Employee surveys also support a return to the office environment. A recent Work from Home survey from Gensler Research Institute revealed that most employees want to return to an office with only 12% saying they want to continue to work from home full-time. And employers know that it is this face-to-face, in-person connectivity that can build a productive, loyal culture and differentiating brand.

- Still uncertain how much of their workforce will come back to the office permanently, some clients whose projects were in process abandoned long-term ROI decisions for near-term adaptations that address safe distancing.

- Many companies are exploring different furniture options, but few are pulling the trigger. For those with the ability to purchase, now could be a good time to purchase, before demand and lead times increase.

- The empathy factor is real among organizational leadership, recognizing that their employee’s health, safety and work-life balance has a new set of emotional and stressful circumstances. Some workers are simply unable to return to work because of compromised health conditions or challenges with childcare or elder care. Will this result in a new set of amenities?

While this situation is still evolving, we believe it presents a differentiating and even transformative leadership opportunity for visionary developers, organizational leaders and their partners.

So much more to gain – starting with our health

Today, at this new moment, our collective vision for rebuilding the workplace is still blurry from the multiple lenses and predictive models.

Prior to the pandemic, our teams were committed to helping clients understand how the health of our environment impacts human health. We are finding increased interest in suggestions that create a more sustainable, healthy workplace, even if owners are not able to act on all those ideas right now.

“What the market needs most is a shift,” adds Calvin Young, Manager of High Performance and Sustainable Construction in Indiana. “There is increasing awareness and understanding of public health science. Our goal is to infuse some knowledge and advice around healthy buildings into the conversation and keep building performance on the table for discussion particularly during this uncertainty. We approach the conversation by laying out the pros and cons of different systems and materials, including the ROI, so our clients can make the best decision for their people, as well as their business.”

Even within the Midwest, our markets are different. Our smaller skylines, like Columbus, Cincinnati and Indianapolis, have less Class A space than Chicago. Tony Budke, Project Manager in Ohio shares his thoughts: “Most office building owners in this market are opting for lower-end investments, like upgrading filters. It may even take a change in regulations before the premium solutions find their way into the workplace.”

Young adds, “We are optimistic that the market demand will make the cost of healthier materials and air quality upgrades more common and affordable, just like LED lighting and low-VOC paint. When they first came into the market, they were expensive and there weren't many choices. Today, both are standard."

Investments worth making

Imagine the workplace as a safe, restorative space—a healthy retreat to recharge and reconnect. We know natural light and views, enhanced air quality, and healthy materials are conducive to human wellness and can enhance productivity and creativity. Is the healthy building model and WELL-certified office about to become more mainstream? We believe the potential ROI is more compelling and more relevant today than ever before.

With a global economy on pause and most industries operating well below targets, adding additional technology, protocols and building standards to existing or planned workplaces may feel like a costly or counter-intuitive proposal. And, while there might be an increase in building and renovation costs upfront, the workplace of the future provides a return on the investment. Returns can be seen from smart energy-saving moves, leveraging “green” grants, adaptable space planning and healthy building benefits and amenities that attract and retain top performers to the workplace and solidify organizational culture.

Our own story proves the value of healthy spaces. Before the pandemic, we launched a new brand strategy, "Pepper Construction, Tomorrow Transformed," with the goal of creating a better quality of life through the spaces we build. It was also time to walk the talk for ourselves, to model sustainable practices and be a leader in carbon drawdown solutions and healthier buildings. Our new Dublin, Ohio, office space is seeking WELL Silver certification, and our future Barrington and Chicago office renovations are also being designed to follow the WELL standard.

Because the Ohio space was about investing in our team and our future, the office required minimal adjustments to de-densify. More importantly, our employees felt some peace of mind in the workplace, knowing we had already set a high bar for indoor air quality, healthy materials and overall human health.

We believe when tenants return to the built environment, real and long-term differentiators will yield premium lease contracts for building owners. Highly visible reminders of healthy amenities and innovation in our offices (temperature sensing monitors, touchless elevators and doors, heat mapping and portable filtration and disinfection units) will become a recruiting tool for today’s more informed and talented workforce.

A bonus for employers who invest in a WELL-certified workplace – a healthy, safe environment does translate directly to improved performance and productivity. According to a Harvard researcher, as employers and employees demand safe spaces, healthier buildings can translate into dollars and cents for the landlord: “Offices with the premier health story will get the premium rent and get the rent and the tenants, and the offices with a lagging health story will lag.” John Macomber, Harvard Business School, author of Healthy Buildings: How Indoor Spaces Drive Performance and Productivity. This is a moment to foster creativity, embrace human health and stay focused on the future of sustainability to set a high bar for the office of the future.

This blog post is part of the Future In Focus series, which analyzes the decision to proceed, as well as the creativity and tools to wisely manage your project. Experts from across the company are weighing in so you can start to sort through all the unknowns and make the most informed decisions possible. We encourage you to subscribe to our newsletter to receive updates.

SIGN UP TO RECEIVE UPDATES

About the Authors